We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Spicing Up the Market: Chipotle's Earnings Beat Heats Up Restaurant Stocks

Read MoreHide Full Article

Chipotle Mexican Grill (CMG - Free Report) reported earnings Wednesday after the market close and did not disappoint shareholders.

Chipotle had another stellar quarter of business activity, growing revenues 14.1% YoY, increasing margins, and opening 47 new restaurants with 43 including a Chipotlane, a drive through option.

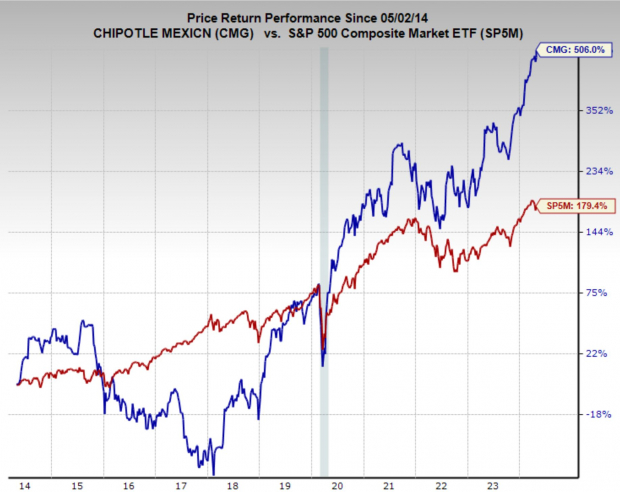

Chipotle Mexican Grill is an innovator in the restaurant space, commercializing the fast-casual concept and leading the way for the industry. Shareholders have benefitted tremendously from Chipotle’s success as the stock has compounded at an annual rate of 19.7%, well above the broad market and industry.

With analyst beating earnings, and a top Zacks Rank Chipotle Mexican Grill makes for a worthy consideration in any investor’s portfolio. Additionally, several other up and coming restaurant stocks offer huge opportunity, and the sector as a whole has shown relative strength during the recent market selloff.

Here we will cover Chipotle’s earnings and share two other top ranked restaurant stock to dive into.

Image Source: Zacks Investment Research

Earnings Results

Chipotle reported a strong first quarter with revenue up 14.1% to $2.7 billion. Comparable restaurant sales grew 7%, driven by higher transactions and menu price increases. Profits were also strong, with adjusted earnings per share up 27.3% to $13.37.

Earnings beat analysts’ estimates by 14.5% and sales by 1.2%.

The company is optimistic about the future, citing successful marketing initiatives and a focus on throughput. They are expecting full-year comparable restaurant sales growth in the mid to high-single digits and plan to open 285 to 315 new restaurants.

Margins saw notable expansion as well, with operating margin rising from 15.5% to 16.3% from last quarter.

Is Chipotle a Buy?

As of today, Chipotle shows continued growth on both the top and bottom line as it cements its leadership in the space. It boasts a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions and forecasts EPS to grow 22% annually over the next 3-5 years.

Additionally, as noted, CMG stock has been displaying relative strength against the broad market, indicating a preference for the stock from institutional investors.

Other High-Flying Restaurant Stocks

The sector has been performing quite well broadly, and a handful of new restaurant stocks have been putting up huge rallies.

Two stocks which have gone public more recently and are posting impressive growth are Wingstop (WING - Free Report) and CAVA Group (CAVA - Free Report) .

While Wingstop is a more traditional chicken wing take-out and eat it restaurant, CAVA Group has been following the Chipotle model very closely. Cava restaurants have similar industrial design, restaurant layout and pricing to the incumbent Chipotle and showing that the setup works.

CAVA Group is expecting sales to grow 19% annually this year and next and is also forecasting net positive earnings results for the first time in the coming quarter.

Both Cava and Wingstop have a Zacks Rank #2 (Buy) rating and are up significantly more YTD in terms of stock price.

Wingstop is forming an especially compelling technical trade setup. Over the last two months, the price action on WING stock has been building out a bull flag. If the stock can trade above the $375 level, it would signal a technical breakout.

Image Source: TradingView

Bottom Line

General wisdom usually says that restaurants are a poor business, however the stocks shared here would say otherwise. Chipotle has been one of the top performers in the market over the last decade, and both Cava and Wingstop are showing huge potential with near-term bullish catalysts.

It is also worth noting that amid the worst selloff in nearly six months, these restaurant stocks are showing relative strength against the broader market. Stocks that show strength while the market is down are usually the ones that lead during the next bull run.

For investors looking to diversify into restaurant stocks, Chipotle, Wingstop and Cava all make for worthwhile considerations.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Spicing Up the Market: Chipotle's Earnings Beat Heats Up Restaurant Stocks

Chipotle Mexican Grill (CMG - Free Report) reported earnings Wednesday after the market close and did not disappoint shareholders.

Chipotle had another stellar quarter of business activity, growing revenues 14.1% YoY, increasing margins, and opening 47 new restaurants with 43 including a Chipotlane, a drive through option.

Chipotle Mexican Grill is an innovator in the restaurant space, commercializing the fast-casual concept and leading the way for the industry. Shareholders have benefitted tremendously from Chipotle’s success as the stock has compounded at an annual rate of 19.7%, well above the broad market and industry.

With analyst beating earnings, and a top Zacks Rank Chipotle Mexican Grill makes for a worthy consideration in any investor’s portfolio. Additionally, several other up and coming restaurant stocks offer huge opportunity, and the sector as a whole has shown relative strength during the recent market selloff.

Here we will cover Chipotle’s earnings and share two other top ranked restaurant stock to dive into.

Image Source: Zacks Investment Research

Earnings Results

Chipotle reported a strong first quarter with revenue up 14.1% to $2.7 billion. Comparable restaurant sales grew 7%, driven by higher transactions and menu price increases. Profits were also strong, with adjusted earnings per share up 27.3% to $13.37.

Earnings beat analysts’ estimates by 14.5% and sales by 1.2%.

The company is optimistic about the future, citing successful marketing initiatives and a focus on throughput. They are expecting full-year comparable restaurant sales growth in the mid to high-single digits and plan to open 285 to 315 new restaurants.

Margins saw notable expansion as well, with operating margin rising from 15.5% to 16.3% from last quarter.

Is Chipotle a Buy?

As of today, Chipotle shows continued growth on both the top and bottom line as it cements its leadership in the space. It boasts a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions and forecasts EPS to grow 22% annually over the next 3-5 years.

Additionally, as noted, CMG stock has been displaying relative strength against the broad market, indicating a preference for the stock from institutional investors.

Other High-Flying Restaurant Stocks

The sector has been performing quite well broadly, and a handful of new restaurant stocks have been putting up huge rallies.

Two stocks which have gone public more recently and are posting impressive growth are Wingstop (WING - Free Report) and CAVA Group (CAVA - Free Report) .

While Wingstop is a more traditional chicken wing take-out and eat it restaurant, CAVA Group has been following the Chipotle model very closely. Cava restaurants have similar industrial design, restaurant layout and pricing to the incumbent Chipotle and showing that the setup works.

CAVA Group is expecting sales to grow 19% annually this year and next and is also forecasting net positive earnings results for the first time in the coming quarter.

Both Cava and Wingstop have a Zacks Rank #2 (Buy) rating and are up significantly more YTD in terms of stock price.

Wingstop is forming an especially compelling technical trade setup. Over the last two months, the price action on WING stock has been building out a bull flag. If the stock can trade above the $375 level, it would signal a technical breakout.

Image Source: TradingView

Bottom Line

General wisdom usually says that restaurants are a poor business, however the stocks shared here would say otherwise. Chipotle has been one of the top performers in the market over the last decade, and both Cava and Wingstop are showing huge potential with near-term bullish catalysts.

It is also worth noting that amid the worst selloff in nearly six months, these restaurant stocks are showing relative strength against the broader market. Stocks that show strength while the market is down are usually the ones that lead during the next bull run.

For investors looking to diversify into restaurant stocks, Chipotle, Wingstop and Cava all make for worthwhile considerations.