This is a paid advertisement sponsored by Blackbird Critical Metals

Miracle Metal Takes Center Stage Amid Russian Conflict

J. Daryl Thompson is a self-proclaimed stock trading “addict” who began his investment career by working for a legendary Houston billionaire investment counselor for 15 years. Early on during his professional career, Daryl designed systems for the analysis, testing, and presentation of data. Originally a country boy from the Deep South with a penchant for numbers, Daryl received a Mathematics degree from the University of Oklahoma. While he eats, lives, sleeps and breathes trading stocks, he also works as a financial and business consultant.

IN THIS REPORT

> A unique discovery in the epicenter of North American titanium

> Billion dollar titanium miner Rio Tinto focused on acquiring juniors

> The U.S. views Canada as a strategic mining partner

> America’s military and aerospace industries rely heavily on titanium

> Titanium and 5 more minerals found on BLACKBIRDs (BBCMF) Tyee Metals Project in Quebec

- The U.S. is at the mercy of both Russia and China for many metals considered essential to our economic and military defense.

- Could a new North American discovery of titanium and five other critical metals help tip the scales back in our favor once again?

By J. Daryl Thompson

If you’re a military history buff – or you’re over 50, like I am…

You may remember the SR-71 Blackbird, a strategic reconnaissance aircraft made by Lockheed.

While the sleek-looking plane was retired in 1990, it was the Cold War’s ultimate spy plane – closer to a spaceship than an aircraft.[1]

But there was something else unique about this plane.

You see, the SR-71 Blackbird was made of an astounding 92% titanium.[2]

In fact, titanium alloy was the only option for the airframe.

That’s because only titanium could provide…

The strength of stainless steel at a relatively light weight.

And the ability to withstand the enormous temperatures generated by flying at 2,200 mph.[3][4]

Unfortunately, the U.S. didn’t have the titanium ore supplies needed.

Unfortunately, the U.S. didn’t have the titanium ore supplies needed.

And the world’s largest supplier of titanium was the Soviet Union, America’s sworn enemy during the Cold War.

But working through Third World countries and bogus operations, the U.S. was able to trick the Soviets into giving us enough titanium ore.

This succeeded, at least in part, by making the Soviets believe that “lazy” America needed more titanium for pizza ovens![5]

Perhaps the Russians have never forgiven the U.S. for this “pizza ploy”…

For tricking them into supplying the very metal our country needed to spy

on their homeland.

I’m not sure.

But here’s what I do know…

Putin’s Russia is still in charge of our titanium supply –

putting our military and aerospace industries at serious risk[6]

I’ll explain more shortly, but first I have some good news.

Just take a look at this geologist sitting on a small hill in Northeastern Quebec.

To the average observer, it may not look like much.

But beneath this hill lies what could be a massive deposit of ilmenite*, the primary ore of titanium metal.[7]

Titanium’s superior properties have earned it the moniker “the wonder metal.”[8]

The silvery mineral is lightweight and resistant to corrosion. Titanium is just as strong as steel but weighs only around half as much.[9]

Right now, we don’t know how extensive this recently discovered ilmenite really is…

Because this area has never been explored – until now.

But in January 2024, a little-known Canadian mining company announced the discovery of multiple massive and exceptionally high-grade titanium occurrences.[10]

With the discovery of five more metals considered “critical” to American national and economic defense…[11]

The company I’m reporting on today is aptly-named BLACKBIRD CRITICAL METALS (BBCMF).

And as you may suspect…

BLACKBIRD (BBCMF) also draws its inspiration from the titanium spy plane you just heard about – the SR71 Blackbird.

A discovery in the epicenter of North American titanium

The 154,000 acre Tyee Critical Metals Project in Quebec – where these discoveries were made – is 100%-owned by BLACKBIRD (BBCMF).[12]

Something else you should know is that only a few days after BLACKBIRD (BBCMF) staked the area for its Tyee Project…

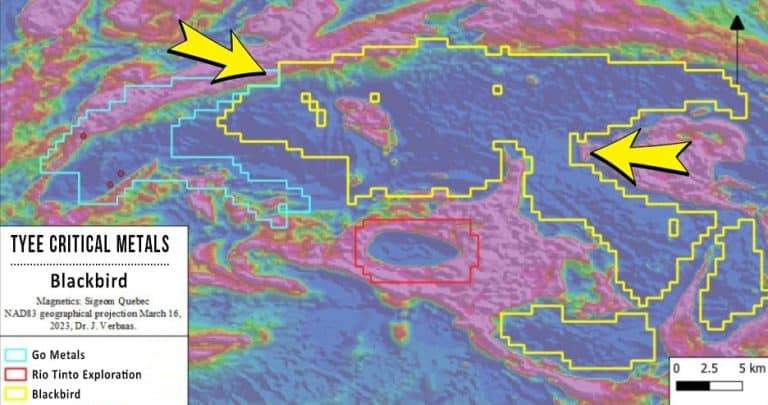

Mining behemoth Rio Tinto took an interest – and staked a much, much smaller area only a few miles away.[13] You can see it outlined in red below (dwarfed by the giant Tyee Project outlined in yellow).

Now, Rio Tinto already owns the world’s largest solid titanium deposit, located a mere 62 miles from Tyee.[15]

Rio Tinto’s titanium mine there has been in operation for over 70 years.[16]

With a smelter, a shipping port, a processing facility and a metallurgical complex, Rio Tinto’s stated mission is to position itself as a “center of excellence” for critical mineral processing.[17]

In partnership with the government of Canada, Rio Tinto recently invested $546 million U.S. to advance the processing of titanium in order to further Canadian and American security of supply.[18]

With all this money and infrastructure invested, I believe it’s feasible that Rio Tinto might want to find additional deposits to keep their mine going for another 70 years.

That’s not just my opinion.

In Reuters in 2023…

Rio Tinto’s CEO Jakob Stausholm revealed the

company’s strategy to focus on small, bolt-on acquisitions

to further shape its portfolio[19]

But getting back to BLACKBIRD’s (BBCMF) new titanium discovery…

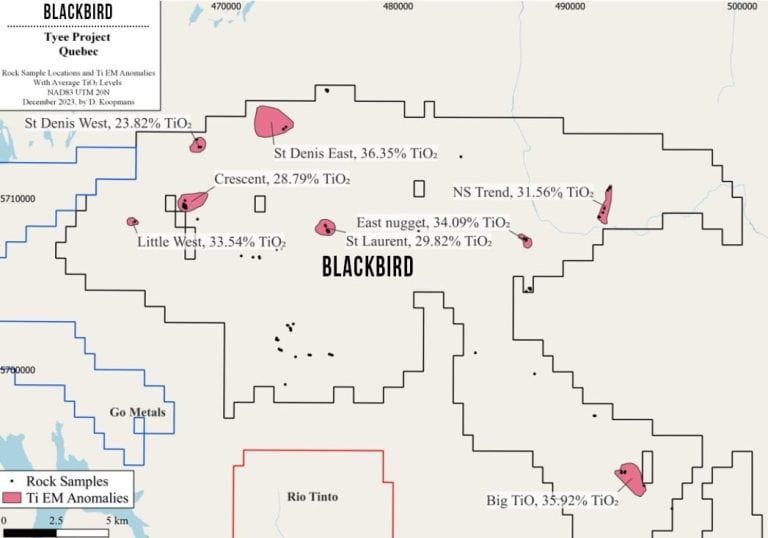

The titanium occurrences at the Tyee Critical Metals Project were found to be massive and of remarkable consistency – with an average grade of 28.1% titanium oxide (TiO2) over 64 rock samples.[20]

“The high-grade of the recently discovered titanium occurrences, as well as the remarkable consistency of that grade, shows that we may have encountered something truly special” – Jaap Verbaas

The largest titanium surface occurrence by recent sampling that contained over 30% TiO2 measured nearly 3000 x 1000 feet. But the underlying geophysical signature of this area appears to be MUCH larger.[22]

BLACKBIRD’s (BBCMF) near-term focus will be to evaluate the strike length, width, and depth of these occurrences with a combination of drilling and ground geophysics.[23]

In a moment, you’ll see why serious resource investors should familiarize themselves with titanium, as well as the other metals found on this project.

But first, it’s important to know why this new Canadian titanium discovery could be such a big deal for neighboring America.

The U.S. Geological Survey has included titanium on its 2022 list of the 50 mineral commodities that are vital to U.S. economic and national security.[25]

And we desperately need to get more titanium out of the ground from regions closely allied with America.

You see…

The U.S. produces next to no titanium. It must rely on imports

for over 90% of its titanium ore[26]

The sad truth is…

Most of the world’s titanium is produced in countries that are considered politically unstable.[27]

In fact, the bulk of the world’s titanium metal production is in the hands of our top two international rivals…

Yep, Russia and China.[28]

Our geopolitical foes are pulling the strings when it comes to titanium – and other critical metals recently discovered on BLACKBIRD’s (BBCMF) Tyee Project.

This puts our armed services and other crucial industries at a distinct disadvantage.

I think you can see how this is a BIG problem…

“Titanium is a 21st-century metal fundamental to the technological

and military aspirations of the world’s superpowers. The U.S. cannot

be left dependent on foreign rivals for this precious metal.”[30]

– Stars and Stripes

Of course, it would be nice to have more titanium mines located within U.S. borders.

However, that’s not happening on any serious scale.

In fact, plans for a titanium mine in Georgia were recently scrapped because of concerns about damaging the environment.[31]

But that’s OK, because…

The U.S. views Canada as a strategic mining ally

Fortunately, Canada is a premier mining jurisdiction…

One of the most mining-friendly countries in the world.[32]

What’s more, Canada still holds a wealth of untapped mineral potential – and a government investing significant time and money into its development.[33]

A 2022 report released by the U.S. White House considers Canada a “domestic source” for mining under existing agreements, providing “potential opportunities for collaboration.”[34]

Yes, our government has formally endorsed mining-friendly Canada as a valued ally when it comes to developing a strong and secure supply chain for critical minerals used in defense and clean energy technologies.[35]

And this is great news for BLACKBIRD CRITICAL METALS (BBCMF) with its North American metal discoveries.

It’s also good news for the U.S.

Especially when the Russians are a leading player in the titanium industry.

Through a Putin-linked company, Russia is the world’s largest titanium producer – with approximately 25% of the global titanium market.[36]

While mines are not located within Russia itself, the country is heavily involved in several crucial steps of the titanium processing and supply chain.[37]

What’s more, Russia has actually been sourcing the bulk of its raw titanium ore from – surprise – Ukraine.[38]

Russian aggression has created a global titanium crisis

Ukraine has the 10th largest titanium reserve in the world.[39]

That’s a key reason why the war in Ukraine has disrupted the titanium supply chain.[40]

It has created a huge problem for western aerospace companies, which are heavily reliant on Russian titanium.[41]

Just consider that Boeing sources 1/3 of its titanium requirements from Russia.[42]

All this means that the Ukraine-Russia war has played the largest role in what has become a global titanium shortage.[43]

And don’t forget the other rival power – China…

China has major reserves of ilmenite ore that account for 30%

of the world's titanium reserves[44]

As I write this, warnings are being issued about shortages of titanium, copper, nickel, and other minerals due to potential Chinese export controls, rising military demand, or even a possible U.S.-China conflict.[46]

Gregory Wischer, the founder of a critical minerals consultancy, warns that the U.S. faces risks to its critical mineral supply chains just as mineral demand for military defense keeps rising.[47]

One policy recommendation that has been gaining traction is “friendshoring,” the process of relocating critical supply chains among geopolitical partners as a way to help reduce mineral shortage risks.[48]

And as Wischer points out, the most secure friendshoring partner for the United States is Canada.[49]

That underscores why I’m telling investors to keep their eyes on BLACKBIRD CRITICAL METALS (BBCMF).

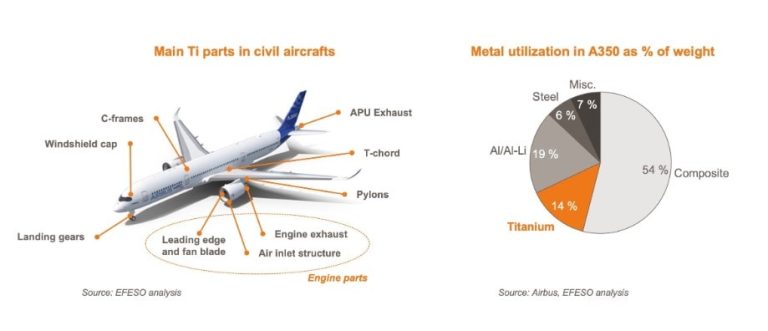

The military and aerospace industries

rely heavily on titanium

Because of its unique characteristics, using titanium resolves a host of engineering problems for the aerospace and defense industries.[50]

Remember, titanium offers the same strength as steel at only half the weight.

It weighs the same as aluminum while being twice as strong.

Titanium also offers one of the highest strength-to-weight ratios of all metals.

And its exceptional performance at high temperatures and its resistance to corrosion make it an ideal component for many aerospace applications.[51]

Titanium alloys with aluminum, vanadium, and other elements appear in planes, ships, missiles, helicopters, and spacecraft in many critical structural and high-performance parts.[52]

The U.S. Navy uses titanium for shipboard components that come into direct contact with the ocean – including those of submarines.[53]

The Air Force takes advantage of titanium’s efficient strength-to-weight ratio, using it in landing gear, airplane frames, and other parts.[54]

The Army and Marine Corps use titanium in tanks, machine guns, and the Stryker combat vehicle.[55][56]

Today, the aerospace industry accounts for 73% of titanium

used in the U.S.[57]

Outside of defense, titanium is used in many commercial aircraft. For example, the Boeing 787 is 15% titanium by weight.[58]

The metal’s heat-resisting properties have made it a superior choice for jet engines and other aircraft parts.[59]

Titanium has also been increasingly popular for use in commercial ships since salt water has almost no effect on the material .[61]

Titanium’s compatibility with other metals in alloys as well as composite materials such as carbon fiber and fiberglass will continue to fuel strong demand for this material in the military and aerospace industries, as well as the commercial sector in general.[62]

3D metal printing has also been a catalyst for titanium usage

One of the hurdles standing in the way of greater titanium adoption has been the difficulty of machining the metal. With such a tough material, it takes specialized cutting tools and processes to form parts.

But the arrival of 3D metal printing has allowed small-scale parts to be easily printed.[63]

With metal 3D printing, titanium can be used for more accurate and effective ballistic protection for most of an aircraft’s critical parts.[64]

Titanium and 5 more metals found on the Tyee Critical Metals Project

On January 9, 2024, BLACKBIRD (BBCMF) announced the discovery of not only exceptionally high-grade titanium, but vanadium and scandium occurrences as well.[65]

Scandium grades were up to 42 g/t and vanadium grades were up to 0.37%.[66],

Don’t overlook the importance of vanadium and scandium

Hard, silvery-gray vanadium is one of the world’s most important metals,[67] achieving notoriety in 1908 as a steel strengthener used in the Model T.

Today, the metal vanadium has countless uses in the automotive, military, and aerospace industries – all applications where strength is required.[68]

Currently, it’s the key ingredient in cutting-edge vanadium redox flow batteries (VRFBs).[69]

As the demand for renewable energy continues to grow, VRFBs are believed to be the future of grid-scale energy storage[70] – projected to consume over 2/3 of vanadium demand by 2040.[71]

The vanadium market size accounted for $2.3 billion in 2022, and is estimated to achieve a market size of $4.6 billion by 2032.[72]

Despite being designated a critical mineral,[73] less than 5% of vanadium is mined and processed in the U.S.[74]

The push for more domestic vanadium sources is strong, since China (by a large margin) and Russia are the world’s top producers.[75]

Scandium is another metal many investors aren’t familiar with…

It’s also included in the U.S. Geological Survey’s 2022 list of critical minerals that play significant roles in national security, economy, renewable energy development, and infrastructure.[76]

Currently, China is the largest known producer of scandium products for global sale, with Russia being the second most significant supplier to global markets.[77]

The single largest use for scandium in commercial application today is to improve performance of solid oxide fuel cells (SOFC’s), which are used as a power source for data centers and hospitals, as well as in lasers and lighting.[78]

The most significant forward-looking market opportunity for scandium is its use as an alloying agent for aluminum. When added to standard aluminum alloys, scandium helps create stronger, more corrosion-resistant, more heat-tolerant, weldable aluminum products.[79]

This is of particular importance for the aerospace, defense, and 3D printing industries.[80] Because of its strengthening and stabilizing properties, scandium is also used in certain lithium-ion battery applications.[81]

The scandium market size is estimated at $646 million in 2024, and expected to reach $992 million by 2029.[82]

Scandium is also another metal that BLACKBIRD CRITICAL METALS (BBCMF) could potentially have in common with mining giant Rio Tinto.

In 2022, Rio Tinto produced its first batch of high-purity scandium oxide at its Quebec mine. This made it the first North American producer of this soft, silvery mineral.[83]

Rio Tinto stated that development of a secure North American supply of scandium can help de-risk the global supply chain for this critical mineral.[84]

But wait, as they say, there’s more…

Finding nickel (and more) in Canada’s newest nickel belt

During the company’s inaugural ground program, BLACKBIRD CRITICAL METALS (BBCMF) also announced the discovery of four nearby occurrences of nickel and copper, with samples that also included cobalt.[85]

BLACKBIRD’s current CEO, Dr. Verbaas is familiar with the nickel in this region and his knowledge and experience appear to have paid off…

Grading of this discovery showed up to 0.75% Ni, 0.81% Cu, and 0.14% Co.[88]

The target, called Little St. Catherines, is ideally located only 9 miles away from the Romaine IV hydroelectric dam and a government-maintained road.

These results, combined with those eight new titanium-vanadium-scandium zones also discovered, place BLACKBIRD (BBCMF) on solid footing with multiple high-value drill targets for its fully-funded spring 2024 program.[90]

If you’re not familiar with nickel, you really should be…

The biggest use for nickel is in producing alloys, combining with other metals to produce stronger stainless and heat-resisting steels.[91]

However, nickel also plays a crucial role in our transition to clean energy.

Nickel, copper, and cobalt – all metals found on the Tyee Critical Metals Project – are required in battery technology and hydrogen fuel cells.[92]

Each electric vehicle (EV) requires 77 pounds of nickel on average.[93]

Nickel demand for use in EVs and energy storage is projected to grow 20-40X by 2040,[94] making nickel one of the most sought-after energy minerals.

Plus, nickel is used throughout the entire spectrum of clean energy technologies: wind, solar power, geothermal, hydrogen, hydro, and nuclear.[95]

This may sound like a familiar and unsurprising tale by now…

Russia is one of the biggest nickel producers in the world – and still a key supplier of nickel to America.[96]

In 2022, the U.S. also imported nearly $78 million worth of nickel from China.[97]

Significant nickel discoveries are hard to come by – and very little nickel mining is done in America.[98]

That’s why commodity expert Alex Laugharne notes that it makes more sense to think about keeping nickel mining and production within North America, rather than just within the U.S.[99]

But what about copper and cobalt?

Copper and cobalt occurrences at Little St. Catherines have also been promising.[100]

Copper is one of the world’s most traded commodities.[101] In fact, the commodities market considers copper to be an economic bellwether.

But it’s also another critical component in the push toward renewable energy and electric vehicles.[102]

“I might be copper’s #1 fan. With larger copper mines coming to the end

of their mine life, we not only need to replace them with new copper discoveries,

but we need even more copper for the green energy transition. That’s why

I believe copper should be in the portfolio of any battery metals company.”[103]

– Dr. Jacob Verbaas, BLACKBIRD CEO

EVs use up to nearly 4X more copper than vehicles with internal combustion engines.[104] In addition, copper is also an essential part of the infrastructure necessary to support EV charging.[105]

According to Wood Mackenzie, the electric vehicle sector will need 250% more copper by 2030 — just to handle the 20 million expected EV charging stations.[106]

And cobalt?

Well, cobalt is another technology-enabling metal important in the green energy transition. It’s an essential component in rechargeable batteries used in electric vehicles.[107]

Cobalt also plays vital roles in the superalloys needed for jet engines, and is used in portable devices such as telephones, tablets, and laptops.[108]

8 Reasons to Put BLACKBIRD CRITICAL METALS (BBCMF) On Your Investing Radar Now

BLACKBIRD CRITICAL METALS (BBCMF) is a company bursting with potential when it comes to titanium, nickel and other metals vital to America’s defense and aerospace industries – as well as the transition to renewable energy.

I believe this young company is well worth your consideration, and here are some major reasons why:

- #1. Promising North American Critical Metal Discoveries – multiple massive titanium-vanadium-scandium occurrences have been found on the company's 100%-owned, 154,000-acre Tyee Critical Mineral Project in Quebec. In addition, four new nickel sulfide occurrences were discovered during BLACKBIRD’s (BBCMF) inaugural ground program with associated copper and cobalt.[109]

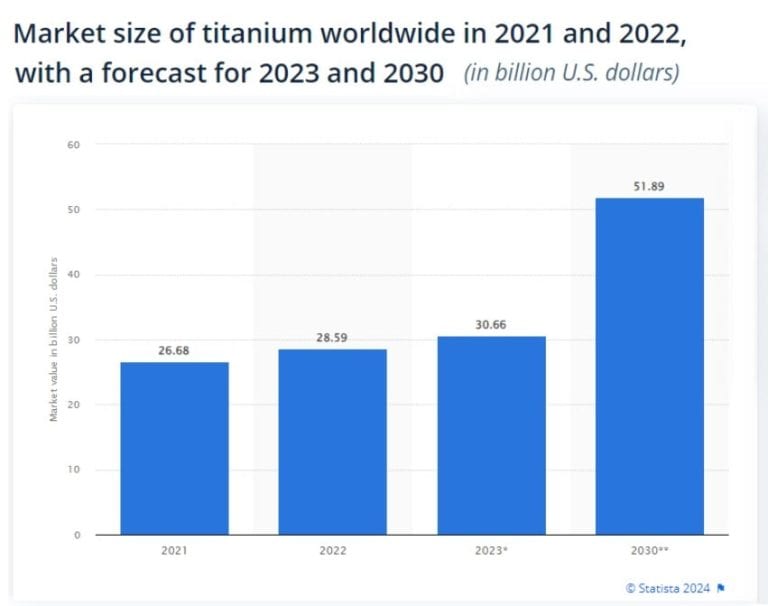

- #2. Titanium’s Growing Global Market – The global market size of titanium in 2022 was $28.5 billion dollars. By 2030, the titanium market size is forecast to grow 82% – to nearly $52 billion dollars.[110] This growth forecast is attributed to increasing demand for titanium from the aerospace, defense, automotive, medical, and construction industries.[111]

- #3. National Security Threats – U.S. dependence on foreign sources of titanium puts American interests at risk, especially since China and Russia – military and economic rivals of the U.S. – have a large and growing share of the world titanium market.[113]

- #4. Oh Canada – BLACKBIRD (BBCMF) offers investors an attractive portfolio of critical resource assets in Canada – a low political risk jurisdiction. The U.S. views mining-friendly Canada as the “51st state” when it comes to mineral supply purposes — and is working to strengthen financial and logistical partnerships with the country’s mining sector.[114]

- #5. Expert Management Team – Led by Dr. Jacob Verbaas, BLACKBIRD (BBCMF) has put together an all-star team of experts with decades of mineral exploration experience working with major and junior mining companies. Their team is also skilled at raising capital to fund vital exploration efforts and acquire additional mineral-rich properties.[115]

- #6. Rio Tinto’s Goal to Acquire Juniors – In 2023, global miner Rio Tinto revealed its strategy to focus on small, bolt-on acquisitions to shape its portfolio.[116] While there are no guarantees, of course, this could potentially benefit BLACKBIRD (BBCMF)*, located only 62 miles from Rio Tinto’s 70-year-old titanium mine.

- #7. Diversification Increases Shareholder Value – In addition to BLACKBIRD’s Tyee Critical Metals Project in Québec, the company has the right to acquire 100% interest in the Muskox Lithium Pegmatite Project located in Canada’s Northwest Territories.[117]

- #8. Strong Financial Position and Primed for Drilling – Unlike many junior mining companies, BLACKBIRD (BBCMF) remains in a strong financial position – fully-funded for 2024 and primed for the first drill program ever on the Tyee Critical Metals project.[118]

Consider BLACKBIRD (BBCMF) as a potential value play

in the titanium and other critical metal mining sectors

BLACKBIRD’s (BBCMF) goal is to keep increasing shareholder value by acquisition, exploration, and development of underexplored projects with significant upside potential.[119]

This could be a rare early-stage opportunity to invest in a company with the potential for acquisition by a major miner.*

Mineral exploration experts say that since mineral deposits tend to form in clusters, prospective areas may be near other areas of known mineralization or existing mine sites.[120][121]

However, since BLACKBIRD (BBCMF) has just started to explore the Tyee Critical Metals Project, this is a pure natural resource speculation play.

While investing in a junior mining company has the potential for higher rewards than other larger mining operations, it also comes with higher risk. And, of course, past performance is no guarantee of future results.*

I am not an investment advisor. But my rule and caution to all my readers is never invest more than you can afford to lose. And do not chase losses. If prices slide, it’s important to resist the temptation to “average down.”*

And to minimize your risk, any investment you might make in BLACKBIRD should be part of a wider asset allocation strategy in your portfolio.

Regardless, I believe my analysis of the potentially huge reward of BLACKBIRD CRITICAL METALS (BBCMF) is a good one.*

I wish you much success in all your investments.

– J. Daryl Thompson | Investingtrends.com

P.S. Still want more information on Blackbird Critical Metals (BBCMF)?

I’d like to offer you access to Blackbird Critical Metals’ Investor Presentation, which you can have at no charge.

I’ll also begin a free subscription for you to our online investor newsletter, InvestingTrends.com.

Sign up below to learn about this investment opportunity.

By signing up above you will receive the InvestingTrends newsletter and 3rd party advertisements. Expect up to 5 messages per week from us. You can unsubscribe at any time at the bottom of any of our emails.

ADVERTISEMENT DISCLAIMER

To more fully understand the Investing Trends website or service, please review its full Disclaimer and Disclosure Policy.

* See our Important Notice and Disclaimer above for a detailed discussion on compensation, risks, atypical results, and more.

[1] https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

[2] https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

[3] https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

[4] https://theaviationgeekclub.com/in-the-early-1960s-soviet-union-sold-titanium-to-the-us-believing-they-needed-it-for-pizza-ovens-but-instead-they-used-it-to-build-the-iconic-sr-71-blackbird-mach-3-spy-plane/

[5] https://theaviationgeekclub.com/in-the-early-1960s-soviet-union-sold-titanium-to-the-us-believing-they-needed-it-for-pizza-ovens-but-instead-they-used-it-to-build-the-iconic-sr-71-blackbird-mach-3-spy-plane/

[6] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[7] https://geology.com/minerals/ilmenite.shtml#:~:text=Ilmenite%20is%20a%20black%20iron,%2C%20whiting%2C%20and%20polishing%20abrasive.

[8] https://www.earthmagazine.org/article/mineral-resource-month-titanium-0/

[9] https://www.factmr.com/report/titanium-market

[10] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[11] https://www.federalregister.gov/documents/2022/02/24/2022-04027/2022-final-list-of-critical-minerals

[12] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[13] Discovery call

[14] https://issuu.com/emergingmarketsconsulting/docs/gama_explorations_investor_presentation

[15] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[16] https://www.riotinto.com/en/operations/canada/rio-tinto-fer-et-titane

[17] https://www.miningweekly.com/article/rio-invests-c737m-in-canadian-critical-minerals-2022-10-12

[18] https://www.miningweekly.com/article/rio-invests-c737m-in-canadian-critical-minerals-2022-10-12

[19] https://www.reuters.com/article/idUSKBN2ZC1W9/

[20] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[21] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[22] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[23] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[24] https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

[25] https://www.federalregister.gov/documents/2022/02/24/2022-04027/2022-final-list-of-critical-minerals

[26] https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

[27] https://www.statista.com/topics/11141/titanium-industry-worldwide/#editorsPicks

[28] https://www.stripes.com/opinion/2021-11-24/Don%E2%80%99t-let-foreign-countries-control-America%E2%80%99s-titanium-supply-3743729.html

[29] https://www.stripes.com/opinion/2021-11-24/Don%E2%80%99t-let-foreign-countries-control-America%E2%80%99s-titanium-supply-3743729.html

[30] https://www.stripes.com/opinion/2021-11-24/Don%E2%80%99t-let-foreign-countries-control-America%E2%80%99s-titanium-supply-3743729.html

[31] https://www.eenews.net/articles/army-corps-deals-blow-to-ga-titanium-mine-reverses-trump-move/

[32] https://www.investcanada.ca/news/31-reasons-invest-canadas-mining

[33] https://www.eenews.net/articles/biden-admin-eyes-funding-canadian-mining/

[34] https://www.eenews.net/articles/biden-admin-eyes-funding-canadian-mining/

[35] https://www.whitehouse.gov/wp-content/uploads/2022/06/CANADA-U.S.-SUPPLY-CHAINS-PROGRESS-REPORT.pdf

[36] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[37] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[38] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[39] https://finance.yahoo.com/news/titanium-reserves-country-10-biggest-155049656.html

[40] https://www.aerotime.aero/articles/the-critical-challenge-of-titanium-shortages-in-mro-supply-chains

[41] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[42] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[43] https://www.thomasnet.com/insights/titanium-shortage/

[44] https://finance.yahoo.com/news/titanium-reserves-country-10-biggest-155049656.html

[45] https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

[46] https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

[47] https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

[48] https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

[49] https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

[50] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[51] https://www.nipponsteel.com/en/tech/report/nssmc/pdf/106-05.pdf

[52] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[53] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[54] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[55] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[56] https://www.earthmagazine.org/article/mineral-resource-month-titanium-0/

[57] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[58] https://www.earthmagazine.org/article/mineral-resource-month-titanium-0/

[59] https://www.addere.com/materials/titanium/titanium-in-the-defense-industry/#:~:text=Titanium%20has%20become%20an%20increasingly,and%20structures%20both%20areas%20use

[60] https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

[61] https://www.addere.com/materials/titanium/titanium-in-the-defense-industry/#:~:text=Titanium%20has%20become%20an%20increasingly,and%20structures%20both%20areas%20use

[62] https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

[63] https://www.addere.com/materials/titanium/titanium-in-the-defense-industry/#:~:text=Titanium%20has%20become%20an%20increasingly,and%20structures%20both%20areas%20use

[64] https://www.addere.com/materials/titanium/titanium-in-the-defense-industry/#:~:text=Titanium%20has%20become%20an%20increasingly,and%20structures%20both%20areas%20use

[65] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[66] https://gamaexplorations.com/news/news-2024/amaamplesupto376i2inewitaniumanadiumcand20240109050602.html

[67] https://www.upsbatterycenter.com/blog/vanadium-is-the-worlds-most-important-metal/

[68] https://www.miningnewsnorth.com/story/2019/06/01/critical-minerals/new-battery-tech-revives-vanadium-interest/5765.html

[69] https://www.stryten.com/essential-power/vanadium-redox-flow-battery/

[70] https://blog.siecap.com.au/why-vanadium-redox-flow-batteries-will-be-the-future-of-grid-scale-energy-storage

[71] https://www.crugroup.com/knowledge-and-insights/spotlights-blogs/blogs-2022/battery-demand-for-vanadium-from-vrfb-to-change-vanadium-market/

[72] https://www.acumenresearchandconsulting.com/vanadium-market

[73] https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

[74] https://www.cedengineering.com/courses/critical-mineral-resources-of-the-united-states-vanadium#:~:text=Vanadium%20is%20among%20mineral%20elements,processed%20in%20the%20United%20States.

[75] https://www.statista.com/statistics/1312490/vanadium-production-volume-worldwide-by-country/#:~:text=Global%20vanadium%20production%20volume%202020%2C%20by%20country&text=In%202020%2C%20the%20country%20with,metric%20tons%20of%20the%20metal.

[76] https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

[77] https://scandiummining.com/products/scandium-markets-and-uses-1/

[78] https://www.riotinto.com/news/releases/2022/Rio-Tinto-becomes-the-first-producer-of-scandium-oxide-in-North-America

[79] https://scandiummining.com/products/scandium-markets-and-uses-1/

[80] https://www.riotinto.com/news/releases/2022/Rio-Tinto-becomes-the-first-producer-of-scandium-oxide-in-North-America

[81] https://scandiummining.com/products/scandium-markets-and-uses-1/

[82] https://www.mordorintelligence.com/industry-reports/scandium-market

[83] https://www.riotinto.com/news/releases/2022/Rio-Tinto-becomes-the-first-producer-of-scandium-oxide-in-North-America

[84] https://www.riotinto.com/news/releases/2022/Rio-Tinto-becomes-the-first-producer-of-scandium-oxide-in-North-America

[85] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[86] https://www.accesswire.com/762020/Gama-Completes-2378-line-kilometres-of-SkyTEM-Geophysical-Survey-over-Tyee-Nickel-Copper-Sulphide-Project-in-Quebec

[87] https://gamaexplorations.com/#!/management

[88] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[89] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[90] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[91] https://nickelinstitute.org/en/nickel-and-a-low-carbon-future/

[92] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[93] https://www.washingtonpost.com/climate-solutions/2023/07/07/ev-range-anxiety-battery-myth/

[94] https://appiancapitaladvisory.com/insights-the-critical-minerals-shortage/#:~:text=Nickel%20represents%201.5%20to%203.1,demand%20compared%20to%202020%20levels.

[95] https://nickelinstitute.org/en/nickel-and-a-low-carbon-future/

[96] https://minnesotareformer.com/2022/03/30/would-minnesota-mining-end-u-s-reliance-on-russian-nickel-experts-say-probably-not/#:~:text=Russia%20is%20one%20of%20the,and%20on%20par%20with%20Australia.

[97] https://tradingeconomics.com/united-states/imports/china/nickel

[98] https://www.spglobal.com/marketintelligence/en/news-insights/research/major-nickel-discoveries-remain-scarce-amid-looming-supply-deficits#:~:text=The%201990s%20and%20early%202000s,remained%20scarce%20in%20recent%20decades.

[99] https://minnesotareformer.com/2022/03/30/would-minnesota-mining-end-u-s-reliance-on-russian-nickel-experts-say-probably-not/#:~:text=Russia%20is%20one%20of%20the,and%20on%20par%20with%20Australia.

[100] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[101] https://www1.equiti.com/blog/posts/2018/august/what-makes-copper-one-of-most-highly-traded-commodities

[102] https://www.bloomberg.com/news/articles/2021-03-19/the-world-will-need-10-million-tons-more-copper-to-meet-demand

[103] From earlier discovery call

[104] https://www.copper.org/environment/sustainable-energy/electric-vehicles/

[105] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[106] https://www.mining.com/ev-sector-will-need-250-more-copper-by-2030-just-for-charging-stations/

[107] https://www.cobaltinstitute.org/about-cobalt/

[108] https://www.cobaltinstitute.org/about-cobalt/

[109] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[110] https://www.statista.com/statistics/1318587/market-size-of-titanium-worldwide/

[111] https://finance.yahoo.com/news/titanium-reserves-country-10-biggest-155049656.html

[112] https://www.statista.com/statistics/1318587/market-size-of-titanium-worldwide/

[113] https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

[114] https://www.reuters.com/article/us-usa-mining-canada-exclusive/exclusive-u-s-looks-to-canada-for-minerals-to-build-electric-vehicles-documents-idUSKBN2BA2AJ

[115] https://gamaexplorations.com/#!/management

[116] https://www.reuters.com/article/idUSKBN2ZC1W9/

[117] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[118] https://gamaexplorations.com/news/news-2024/amaamplesupto075ickeland081opperinewick20240116050601.html

[119] https://issuu.com/emergingmarketsconsulting/docs/gama_explorations_investor_presentation

[120] https://www.rangefront.com/blog/8-steps-mineral-exploration

[121] https://www.visualcapitalist.com/mineral-exploration-roadmap/

Ad Note References:

https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

https://www.efeso.com/knowledge/insight/the-impact-of-the-russia-ukraine-conflict-on-the-aerospace-supply-chain-which-are-the-options-to-replace-russian-titanium

https://www.federalregister.gov/documents/2022/02/24/2022-04027/2022-final-list-of-critical-minerals

https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

https://theaviationgeekclub.com/in-the-early-1960s-soviet-union-sold-titanium-to-the-us-believing-they-needed-it-for-pizza-ovens-but-instead-they-used-it-to-build-the-iconic-sr-71-blackbird-mach-3-spy-plane/

https://www.thomasnet.com/insights/titanium-shortage/

https://carnegieendowment.org/2024/02/12/u.s.-military-and-nato-face-serious-risks-of-mineral-shortages-pub-91602

https://www.whitehouse.gov/wp-content/uploads/2022/06/CANADA-U.S.-SUPPLY-CHAINS-PROGRESS-REPORT.pdf

https://migflug.com/jetflights/remarkable-airplanes-of-the-world-part-1-the-fastest/#:~:text=Retired%20SR%2D71%20pilot%20Lt,faster%20than%20a%20speeding%20bullet.%E2%80%9D&text=Temperatures%20of%20the%20SR%2D71,F%20~290%C2%B0C)

https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

https://www.earthmagazine.org/article/mineral-resource-month-titanium-0/

https://www.thomasnet.com/insights/why-military-aerospace-industries-rely-heavily-on-titanium/

https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

https://www.stripes.com/opinion/2021-11-24/Don%E2%80%99t-let-foreign-countries-control-America%E2%80%99s-titanium-supply-3743729.html

https://www.bbc.com/future/article/20130701-tales-from-the-blackbird-cockpit

https://www.chemours.com/en/about-chemours/global-reach/florida

https://tmstitanium.com/news-post/titanium-and-the-aerospace-industry

https://www.globalsecurity.org/military/systems/aircraft/f-22-mp.htm#:~:text=The%20high%20performance%20capabilities%20of,offer%20better%20protection%20against%20corrosion.

https://www.realclearpolicy.com/articles/2021/05/13/us_titanium_supply_chain_needed_for_national_security_776880.html

https://www.earthmagazine.org/article/mineral-resource-month-titanium-0/

https://www.factmr.com/report/titanium-market

https://www.statista.com/statistics/1318587/market-size-of-titanium-worldwide/

https://finance.yahoo.com/news/titanium-reserves-country-10-biggest-155049656.html

https://www.stripes.com/opinion/2021-11-24/Don%E2%80%99t-let-foreign-countries-control-America%E2%80%99s-titanium-supply-3743729.html

https://www.cnet.com/tech/mobile/apple-announces-iphone-15-pro-models-with-titanium-enclosure/

https://www.thomasnet.com/insights/titanium-shortage/

https://www.boeing.com/company/key-orgs/boeing-global#overview

https://mentourpilot.com/boeing-stops-buying-russian-titanium-airbus-continues/